The value propositions of Rent the Runway, The RealReal and Stitch Fix are indisputable. As these concepts grew quickly through the 2010s, the digitally-driven rental, resale and subscription business models induced dopamine rushes in the fashionista set and strategic anxiety among fashion industry execs.

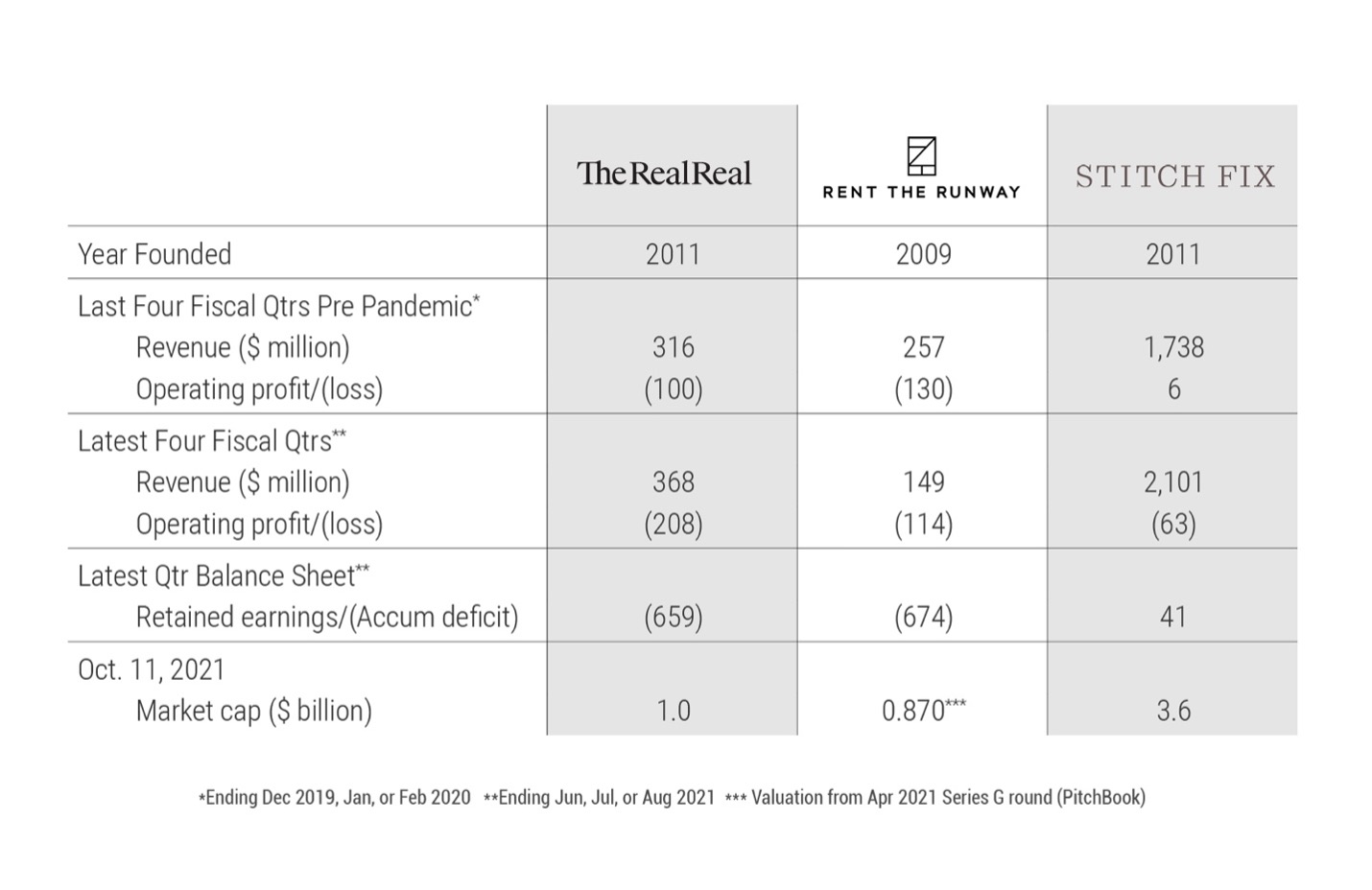

Yet RENT and REAL gush red ink – arterially. Even pre-pandemic. SFIX was nominally profitable until the pandemic and is now back to profitability in its most recent quarter, but the company’s multiple growth initiatives, I believe, will likely not add much more to the bottom line.

So, why don’t these fabulous concepts also make fabulous money?

The RealReal

Buy gently used upscale and designer fashion at a fraction of retail? What’s not to like? Consign your least joy-sparking items for a quick buck? Ditto. The RealReal, while experiencing a dip during the pandemic’s depths, continues to grow revenue and customers significantly over 2019 levels.

The company will never make serious money if any at all. Its accumulated deficit in retained earnings last quarter summed $659 million. The major problem is the high variable cost of receiving, processing, and inventorying individual items for resale. Think: Opening the consignor’s box, inspecting, authenticating, photographing, retouching, pricing, describing, posting, and warehousing each item. Then add on consignor acquisition cost, CAC, fulfillment and, in many cases, reprocessing the return. The contribution profit per order in 2019 was a record high $20 per order, while the fixed cost per order was $53. I estimate they’ll need to sell four times their 2020 revenue before they make a decent return to investors.

That won’t be easy. Fashion resale is a huge business offline, where the intake and selling processes are less labor and fulfillment intensive; and even then, judging by the lack of corporate chains in resale and the predominance of nonprofits, it’s not a big, per-store moneymaker. There’s also plenty of online competition: think Vestiare and ThredUp (a more mass model but also burning cash) and the platforms Poshmark and eBay, among other formats. You might be surprised where the largest number of authenticated Birkin bags are offered.

Rent the Runway

My wife founded and ran a nonprofit. During her 10-year anniversary campaign (in the Before Covid Times), she pitched big money donors and attended many events. Her wardrobe solution was, of course, Rent the Runway. Given her exquisite taste, even her for-profit husband was thrilled at the selection and flexibility the service afforded – for a perfectly reasonable, subscription price.

Reasonable prices for customers, yes, but not for shareholders. Like REAL, RENT’s business model is operationally complex. Returns are built into the model. After wearing, each garment is shipped back, received, cleaned, and returned to inventory. And depreciated. Even in its last pre-pandemic fiscal year, investors would have been better off if, for every dollar a customer spent, the company simply rebated $1.50.

RENT has been in business for over 10 years, and still filed its S-1 as an “Emergent Growth Company” entailing a “high degree of risk” for future buyers of its common stock. Another sign that the business model is inherently problematic is RENT’s lack of peers. LeTote filed for Chapter 11 and seems a shell of its former self. CaaStle supplies a rental platform for other brands to use. Who did I miss? Who’s killing it in clothing rental?

Stitch Fix

SFIX has a different value proposition than REAL and RENT, and a business model architected to make money. The company’s clients subscribe to receive personal style advice and periodic outfit selections, in return for buying, at full ticket, items mostly in the better and contemporary price segments. Healthy gross margins, check. If a client returns everything and purchases nothing that period, they still pay a $20 styling fee.

The company further utilizes an array of 140 data scientists who match purchase behavior with customer demos and product characteristics to model and maximize conversion and AOV and minimize returns. Check, check and check. The company also uses the data to guide development and selling of higher-margin private brands. Finally, the business continues to grow its topline, even through the pandemic by expanding into new customer segments (plus, kids, men’s) and geographies (the U.K. so far).

SFIX returned to nominal profitability in its latest quarter, but implicit in its reporting of outsize growth in and emphasis on non-core growth strategies is that the core women’s business – its largest and likely most profitable segment — has matured, despite a ~$250 billion TAM. (What keeps an articial lid on their women’s business, it seems to me, is that their brand imaging is too literal and practical rather than aspirational and emotional.)

The Business Back Story

These three businesses are all 10+ years old. Why haven’t they yet figured out their profit models? I have a few thoughts.

All three of these concepts were/are venture financed. These tech entrepreneurs and financiers are willing to take on substantial risk to play the long game, solve for complex business models, invest until they completely dominate their sector, and figure that’s approximately where “scale” will begin to deliver an ROI.

It’s worked before. High fixed cost creates a barrier to entry; low variable costs create a steep and predictable glide to profit. But when variable costs are also high (and contribution margin low), as in the cases of RENT and REAL, the path is longer, and the expected error dilates. What happens if the market ends up being smaller than you thought, becomes very competitive, or the model is just inherently unprofitable at any scale? Well, maybe the public markets will be frothy enough to bail you out.

In SFIX’s case, I believe founder and former CEO, Katrina Lake, always had the company’s profit model guide its decisions. However, I think she and company shareholders may have overestimated the ultimate appeal, and peak SOM, of subscription clothing for all.

A wild card in these models is stock-based compensation, which applies to SFIX currently and may affect the others’ future P&Ls — if they should be so lucky. For the top-tier executives living in San Francisco (SFIX, REAL) and NYC (RENT), they accept relatively “modest” salaries and finance their Model S Plaids with stock grants and options. SFIX traded largely flat after its debut four years ago, mostly in the $30s, until this winter, when prices briefly rose over $100. Stock- based compensation this last fiscal year blew a $100 million hole in its P&L.

There’s always the pivot. In recent earnings calls, REAL mentioned that they are opening more stores – because they are more profitable; RENT now encourages you to buy its clothes; and SFIX is strongly promoting its new, “Freestyle” non-subscription platform. Less dopamine, but more real.