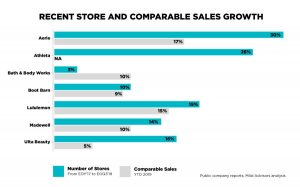

The Abercrombie & Fitch brand and specialty chain is on fire. Sales grew 30 percent YoY in the last four reported quarters. The share price of Abercrombie’s parent ANF has rocketed from $35 to a high of $194 in the last year, aided in part by sibling brand Hollister’s 10 percent growth over the period.

The previous high point was $85, hit in April 2007. Once considered an icon of mall-based specialty retailing, Abercrombie had become increasingly irrelevant, rocked by scandal, and dispatched as a canceled relic of the dying mall economy. So, what accounts for this remarkable turnaround?

A Complete Reinvention

Credit goes to Fran Horowitz and her management team. When Horowitz was elevated to CEO in February 2017, sales and profits were sliding and shares were at $12. Her mandate: a complete reinvention – of talent, culture, and processes in the back of house; brand, product, marketing, and stores in the front. Of course, they also needed to stabilize performance, manage through the pandemic, and endure ongoing brand reputational hits from damaging media reports on Abercrombie and its former CEO Mike Jeffries, who left the business in 2014.

I attribute the brand’s turnaround to three foundational initiatives: re-engineering merchant processes, reinventing the brand, and accelerating digital investments.

Re-Engineering Merchant Processes

When Horowitz took over, the merchandising function was broken. Jeffries was notorious for controlling or at least approving all customer-facing creative decisions. For clothing, this extended from the “no black” stricture (black was considered “too dressy” for the Abercrombie brand), to building the line and determining the cut, make, and materials in a garment. From the beginning, the buyers were “glorified sourcers,” according to one former exec. When the merchant princes reigned over much of specialty fashion retail in the 1980s and 1990s, similar divisions of labor sometimes worked famously well. But over the years the ANF corporation became wildly more complicated growing Abercrombie Kids, Hollister, and Gilly Hicks, while also expanding into new store formats, channels, and geographies. When this geometric growth in complexity proved beyond the capacity of Jeffries to make every decision, the merchants had limited experience and capability to step up.

Under Horowitz’s leadership, the merchants were given both longer-term strategic and shorter-term tactical responsibility for building their merchandise categories and incorporating customer, competitive, and fashion trends into their work. Re-engineering the role of the merchant had become standard at The Limited Inc. in the mid-to-late 1990s, but Jeffries’ Abercrombie was so uniquely successful at the time that he was exempt from the mandate. The current re-engineering took a substantial investment in process redesign, consumer research, and new talent – and needless to say, several years to operationalize and optimize.

Reinventing the Abercrombie & Fitch Brand

Evolving the Abercrombie brand was an even bigger hurdle. There was no clear endpoint, and thus, no roadmap. In the 1990s, Jeffries and The Limited Inc. CEO Les Wexner created a fictional narrative of the aspirational customers – a ripped, handsome, cool guy and his equally comely, totally natural girlfriend, both juniors at the University of Virginia living a full frat/sorority social life; and (when wearing clothes) dressed in casual prep. The idea behind these images was that teens would buy into the brand because they aspired to look like them, socialize with them, date them, be them, etc.

Jeffries famously said the brand was designed “not for everyone” but for the “cool kids.” Its lifestyle brand architecture was copped from the luxury designer world with Ralph Lauren as the biggest influence. Indeed, Abercrombie quickly became the teen luxury brand, offering premium fabrics, premium prices, and a club-like store atmosphere.

This positioning worked fabulously. In fiscal year 1999, the brand achieved a billion dollars in sales and wait for it, a 23.5 percent operating margin. The brand continued to grow until the Great Recession in 2008/09 (which impacted nearly every premium brand), but mostly recovered by 2011.

- Fall From Grace

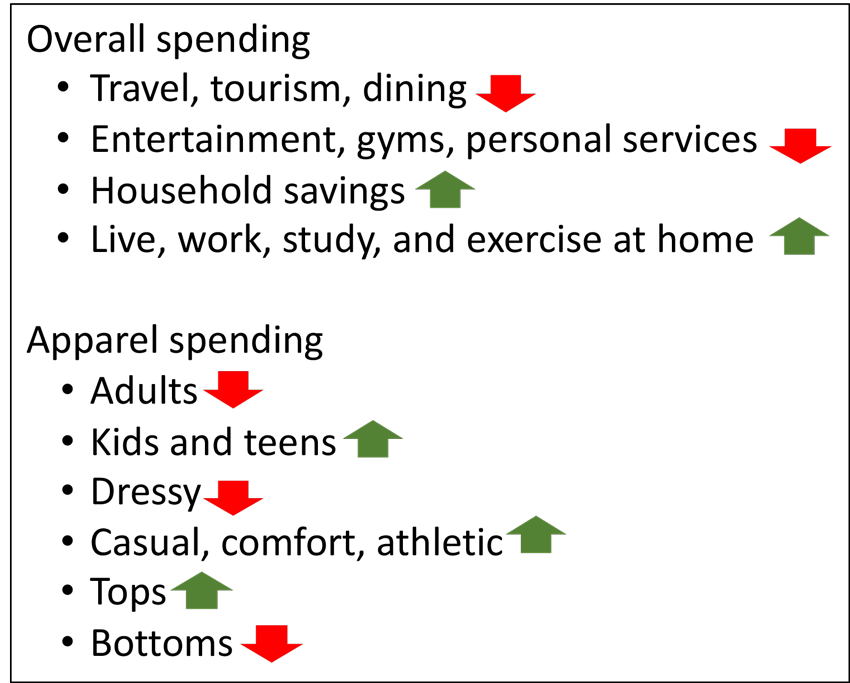

It worked, that is until it didn’t. Beginning in 2012, the brand entered a seven-year slide, eight if you include the pandemic. The brand had edged to $2.1 billion in sales in 2011. By 2019, it shrank to $1.5 billion.

There are many reasons for Abercrombie’s decline – the quick rise and cannibalization from Hollister, the tsunami of smartphone culture and ecommerce, and declining mall traffic, etc. But perhaps the most significant factor was that the Abercrombie brand was increasingly considered not just out of touch but also actively discriminatory. The focus on the singular “hero” body and attitude no longer exerted its pull.

- Rising From the Ashes

Most new CEOs tasked with saving a legacy brand would reference its “deep heritage” (Founded in 1892!). But Horowitz and her team had other ideas. They knew in 2017 that the brand needed to become more modern, inclusive, and digitally driven; millennials aging out of their teens were still the largest segment of the population and the teen specialty apparel space, led by the American Eagle and Hollister brands, was hotly contested. Hollister’s sales surpassed Abercrombie’s in 2012.

But Horowitz wanted to get all the foundational stuff done first, stabilize the business, and fix the merchant function. During this transitional period, the team did major consumer-listening as well as merchandise and marketing testing. Horowitz’s catchphrase at the time was, “Patience.” You could see that their assortments were evolving, but it was unclear what the final destination was.

Then at their June 2022 investor day, the corporation announced that they were no longer targeting teens with Abercrombie, but rather millennials and adults 21-40+ years. Corey Robinson, a talented creative and merchant, was elevated to Chief Product Officer in September 2023. In the Q4 2023 Investor Presentation, the team further fleshed out the new positioning. They killed the drop-dead, gorgeous college kids. They incinerated the prep. In the stores, on the website, and on their social media, there was not one whiff of the legacy brand (except for their fragrance, Fierce).

Accelerating Digital

Jeffries always promoted the youthful attitude of ANF’s brands, and his creative vision was most vividly imagined in analog. The younger Horowitz and her even younger team better understood digital natives.

They began closing Abercrombie flagship stores in New York and other international fashion capitals and invested more heavily in digital marketing, ecommerce, and unified commerce capabilities. These investments proved prescient during the pandemic. In 2022, as part of their “>>FWD >>” strategic plan, they announced an initiative to “Accelerate an Enterprise-Wide Digital Revolution,” propelling investments in customer analytics and a concerted effort to improve the customer experience. To increase awareness and buzz around Abercrombie’s new brand positioning, the plan was to spend more money on digital and influencer-driven marketing.

Interestingly, their digital and real estate strategies are nuanced by nameplate. With 260 stores, Abercrombie is primarily a digital brand, with about 60 percent of sales in ecommerce. In contrast, Hollister customers are fully engaged digitally but prefer to buy in their 500+ stores, with only 30 percent of sales online.

They Aren’t Done

Completely reinventing a brand is courageous. That A&F has seen robust, early success with their new brand positioning is, well, impressive! But, in my view, the team isn’t yet done.

- When you walk into a store or visit the site, you cannot immediately tell where you are. There is no design signature, no unique voice. You don’t yet feel like you “know” this brand; you have no emotional associations, no hits of dopamine. They still lack an updated, holistic brand identity.

- For now, they’ve done a great job designing and assorting products for their target customers, creating a great shopping experience and drawing in their new target customer segment. But there is nothing distinctly different from their competition.

I do find the brand today “hotly inclusive”: Millennials in a range of races, ages, sizes, gender identifications (at least during Pride month), occasions, and locations, all express confidence. Perhaps there is something to own there, but it is not yet “signature.” Given the team’s track record, I can’t wait to see what’s next.