Being declared nonessential during the Covid-19 pandemic lockdowns perfectly captures the literal truth about mall-based specialty retail.

In fact, specialty stores only exist in the first place because they are magic. They invite us into beautiful stage sets, create new aspirations and help cater to our most refined tastes. Les Wexner, the one-time owner of over a dozen specialty retail chains, frequently reminded his executives that they were in the “wants” business, not the “needs” business. His most scathing (and still printable) critique of his brands’ marketing or displays would be “this looks like JCPenney.” The more magic his stores created, the more margin. The…math…was…that…simple.

Over the past decade, we’ve witnessed a broad and steady decline in that magic, inflicted in part by the infectiousness of a handheld supercomputer that brings the world directly to us. During this pandemic, we worry whether a trip to the mall would be safe; but the journey had already become increasingly unnecessary and banal.

So, what’s next for the malls and their tenants?

The Covid Chronicles

There’s a group of retail executives in Columbus, Ohio who are still committed to perpetuating that magic. We call ourselves CBUS Retail, with the motto, “We love retail.” We are currently producing — supported by Klarna and other like-minded sponsors – a nine-episode, streamed video series entitled “Specialty Retail in Crisis: The Covid Chronicles.” The series describes the massive disruption in this sector, paints a view of its future and suggests strategies for post-pandemic success. So far, we’ve interviewed 40 analysts, operators and founders from retail hubs across the country. Here is a synthesis of the series.

1. Pre-Covid

Of course, the mall economy was already troubled well before the pandemic, plagued by a persistent supply-demand imbalance, eroding margins and falling productivity. The dynamic duo, Michael Dart and Robin Lewis list several key reasons:

- Oversupply

- Persistent falling manufacturing costs.

- Continued growth of non-mall options – discount, value, outlet and off-price; clubs and big boxes; everything digital.

- Shrinking demand

- The mall’s targeting of, and dependence on a shrinking middle class.

- Consumers spending more on experiences and health & wellness, and less on physical products (aka “dematerialization”).

Other speakers highlighted two other distinct failures of the mall’s tenants:

- A generation’s-long inability of department stores to increase mall traffic.

- Specialty chains’ increasing lack of novelty, creativity and differentiation.

In short, too much product, too many stores, and not enough magic.

2. Direct Impacts of the Pandemic

If zombie malls with zombie stores filled with zombie product populated much of the retail landscape pre-pandemic, Covid-19 appears to be finally killing off many of these walking dead. Since March, retailers will have announced the closure of an estimated 25,000+ stores, and a net ~300 malls are projected to “repurpose” or succumb during the next three years. So far, over two dozen specialty and department store retailers have declared bankruptcies, with most emerging much slimmer, with new owners. We are told to expect more Chapter 7’s and 11’s this spring.

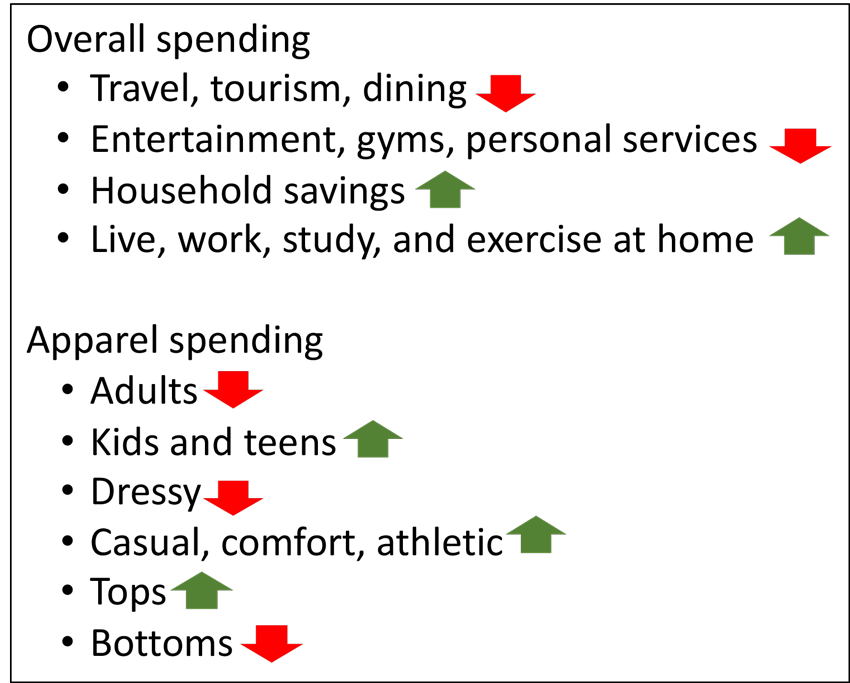

NPD’s Marshal Cohen describes “The Discretionary Divergence” in consumer spending.

3. The Silver Lining

As the pandemic continues to wreck stores, profits, jobs and livelihoods, not to mention lives, our speakers see plenty of future upside for the sector. First, much of the structural oversupply will be gutted from the marketplace. BMO Capital Markets analyst Simeon Siegel argues that the current crisis allows public retailers to strategically downsize without incurring shareholder ire. Most agree that digital commerce is racing through puberty during the pandemic and now stands at least as tall as its offline parent. All in all, there’s a scramble to re-form and reform retail: The future of specialty retail is up for grabs.

4. The Future

A More Diversified and Dynamic Landscape, With Faster Lifecycles and Lower Peaks

With malls and legacy retailers hobbled, the barriers to entry for emerging retailers have never been lower. Traditional wholesalers and DTC brands are finding more mall vacancies with lower rents and more flexible terms, according to Steve Morris, Asset Strategy Group’s CEO. Ottawa-based Shopify provides inexpensive Retail-as-a-Service to over a million ecommerce merchants, who can also co-list their products on other shopping and social platforms including Amazon, eBay, Facebook and Instagram.

Forrester’s Sucharita Kodali foresees an intense battle over the next decade between legacy analog brands now adopting digital first mindsets vs. digital natives seeking heightened customer connection and growth through operating stores.

Whoever wins, the spoils will likely be smaller than before. Analog-first brands that took a generation or more to build tend to top out at $2-3 billion in the U.S. at retail, according to Siegel, with only NIKE swooshing beyond. The current generation of venture-fueled concepts – monied, impatient, and viral-when-successful – will peak faster, but at a level limited to consumers’ goldfish-sized attention spans.

Given the increasingly complex and integrated nature of the equation, analog + digital = sale, J.Crew’s Billy May believes we should focus mostly on market and customer profitability, not channel.

Oliver Chen of Cowen argues that community is the unlock for sustaining consumer loyalty in an attention-deficit world. Aerie and Glossier use social media especially well to foster engagement, according to Chen. Pre-pandemic, Revolve, a brand positioned to party, hosted big, fab, in-person parties instead of investing in brick and mortar.

A Re-Engineered Retail Value Chain

During the pandemic, the design and merchandising teams at the tween girls’ retailer Justice took the whole product development process virtual — from inspiration to concept to line — removing months from their calendar. The compressed timelines prioritized merchant conviction and improvisation ahead of test-read-react. Truly energized by the speed, efficiency and empowerment in the new process, VPs Kat Depizzo and Julia Hanna are convinced these changes will largely be permanent.

More frequent and smaller buys closer to floorset/listing is a recurring theme. Lower markdowns will make up for slightly higher unit costs. Supply chains will be leaner, faster and more distributed, avoiding single points of failure. Inventory transparency is doubly important as omnichannel options proliferate. Good forecasts are the ultimate lubricant in a lean, forward-positioned supply chain. From a tech perspective, Karl Haller demonstrates how IBM projects demand to the store level.

In stores, all agree that we’ll move towards contactless customer service and payments post-pandemic. Kodali states, “a customer should never have to wait in line to talk to a person.” WD Partners’ Lee Peterson reports that Alibaba is way ahead on these and other innovations in his talk “Innovation, Alibaba Style.” There was widespread agreement that Chinese companies and consumers provide a good benchmark for what’s ahead.

A New Role for Physical Stores

Cathaleen Chen wrote a Business of Fashion article in August, both profound and so obvious (as in why-in-my-decades-in-this-business-hadn’t-I-thought-of-it kind of obvious). There are four roles for physical stores: brand, service, immersive experience and community. Think slow on this.

A future strategy for a market-based store “portfolio” makes sense. Some stores offer full brand presentation, high-touch service and interactive community building; at the other end of the spectrum, are dark stores that only fulfill pick-ups and deliveries.

Less Algorithm, More Imagination

Author of “Aesthetic Intelligence,” Pauline Brown, states that in business there should be a tension between analysis and aesthetics. But that the only way to beat the robots is through the uniquely human ability to create beauty, infuse joy, and surprise and delight customers.

Aaron Walters, CEO of Altar’d State, asserts that the larger a business gets, the more it needs to either simplify the model or empower its employees. He advocates bringing the “special” back to specialty retailing.

Former Google executive and arts student, Abigail Holtz, observes that ecommerce has not evolved for 20 years and now seems emotionless and flat, not effortless and fun; and stores have their own shortcomings. She created online shopping site The Lobby to merge the best of both channels, where they curate emerging brands “doing something special” and make shopping fun with an original, authentic and very human-centered interface.

Magic.

NOTE: This is just a small sample of the smart commentary in the series. Please visit https://cbusretail.org/covid-chronicles-season-one/ to stream for free and join our live Community Roundtable https://cbusretail.org/member-events/ on January 6 to discuss the series content with several of the speakers.