With its U.S. sales, earnings and customer affinity deteriorating, many analysts are questioning the future of Victoria’s Secret. In his Robin Report article “Behind the Curve,” Robin Lewis credits Les Wexner’s historic ability to predict big shifts in the market, but wonders whether the brand’s unmoving, sexy positioning – long an asset – might be the primary cause in the brand’s current troubles.

Too sexy for #metoo?

In fact, the brand’s marketing has long been criticized (even in internal debates among company executives) for making sex too overt and overly objectifying the better half of humanity. But up through 2015, as brand sales approached $8 billion and operating earnings $1.4 billion, no one could argue it was bad for business. What changed? Is the long arc of fashion currently bending towards natural beauty and away from sculpted artifice? And has the current wave of pussy hats and #metoo feminist activism accelerated the beginning of the end of this iconic brand?

Those old enough might recall that the brand previously changed its positioning. Up through most of the 1990s, Victoria’s Secret was literally Victorian, with an address in London. The brand had a proper English call-center operator; the stores’ design metaphor was a Victorian boudoir; and the brand imagery most often featured a very English-looking and sounding model named Stephanie Seymour, who was often shown wearing lacy nighties and figure-revealing sportswear as often as lingerie.

Rebrand #1

Beginning in the mid-1990s, Wexner decided to change everything. First, he reengineered the product development process so that it began with the internal design team instead of the merchants. The brand became “Design-driven, merchant-led.” Second, he distorted all aspects of the business — talent, time, inventory, displays, marketing, etc. – towards bras. Third, Wexner and his team defined a new brand architecture for Victoria’s Secret, modernizing its imagery and voice, creating a more aspirational, young and fashionable American brand.

The brand’s DNA was codified into “sexy” and “modern.” Design would produce, ahead of every season’s development, large foam core ideation boards showing “what is sexy now” and “what is not sexy now.” Sometimes the ideas were expressed in video. The tagline was always: “The most beautiful women in the world wear Victoria’s Secret.” These simple guidelines allowed the brand to both evolve with the times and help define — through its catalogs, TV ads, fashion show, digital and PR presences, stores and product – the idealization of modern, sexy beauty for much of America.

A brand re-engineered

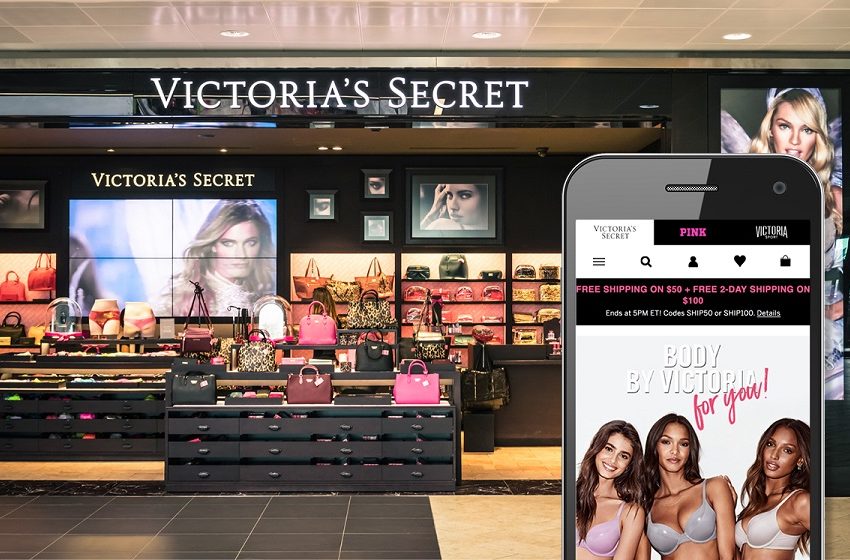

This reengineering within a new brand framework opened up major market opportunities. Sub-brands Body by Victoria (targeting everyday wear) and PINK (targeting more youthful customers and casual occasions) were invented, each with its own brand architecture and business plan. Victoria’s Secret’s design team was supplemented by the corporation’s Limited Design Services, enabling the brand to launch multiple new product lines every season. Each product line had its own defined set of benefit layers, technical + functional + emotional. Each launch was meticulously coordinated across media and sales channels, with resources calibrated to the perceived market opportunity. When faced with the eventual limits in design-, merchandising- and marketing-driven growth, Wexner then pushed for best-in-class operational excellence in manufacturing and supply chain quality, read-and-react speed and selling effectiveness.

The brand, domestically at least, has now hit a wall. What should Victoria’s Secret – this weaponized specialty retail megabrand — do next? Fashion consumers like to shop, and they’ve always been attracted to novelty. The internet has made shopping efficient, and competitors and choices abundant. It seems the natural limit on how dominant a single brand can be over a sustained period of time has shrunk. By a lot.

Rebrand #2?

In my view, the options for Victoria’s Secret are limited, and not at all obvious. Those who think the brand should reposition towards something less sexy and more natural should consider:

- Current Victoria’s Secret customers are still fueling a profitable $7 billion business.

- They are among the most fashion-driven consumers, likely to buy relatively expensive, high-margin bras with sculpting features, and buy multiples every season.

- There is no doubt the “natural” segment is growing faster today, but would it be possible to own that market space even close to the extent that Victoria’s Secret owns “sexy?”

- Will pursuing this lesser-volume, more-competitive, and lower-margin segment be worth the risk of diluting its current brand equity?

- Wexner believes the long arc of fashion will bend back to sexy. I use the term somewhat tongue in cheek — fashion trends will whipsaw as often as they bend.

Become a Platform?

Why shouldn’t the corporate parent leverage its retail, merchandising and product development expertise to develop more VS brands, sub-brands and business units?

The fact is, Victoria’s Secret is already a platform – for lingerie, beauty, PINK and sport. This brand travels online and overseas. But Wexner determined that the brand’s apparel, swim and the catalog were not worth the added complexity. L Brands’ attempts to create other standalone intimates concepts have not gone well: Intimissimi failed in the U.S., Cacique was offered up as a Lane Bryant sub-brand and La Senza struggles. The corporation is itself a platform, operating, in addition to 1,200 Victoria’s Secret Stores, 1,700 Bath & Body Works, 124 La Senza and 27 Henri Bendel stores. L Brands used to host eight apparel divisions; Bath & Body Works gave birth to C.O. Bigelow but had to bury it a few years later. (Wexner once told a small group, “Being right a third of the time is still Hall of Fame ball.”)

The plain truth about the platform solution is that the business of specialty fashion retail is not at all like Facebook, Google or even Amazon. There are few network economies, and sharing data across brands with different target consumers is worth very little. Specialty brand execution is idiosyncratic, not a formula. It requires obsession to detail and focus; that’s what makes it special. Finally, it’s just damned hard: ask GPS, URBN, ASNA, ANF, and CHS.

Manage Maturity?

Wexner has asserted that shoppers will once again return to malls because we are inherently social animals, and malls that adjust will revive. Assuming the long arc of fashion bends back to sexy, then managing maturity is the most logical choice. The brand has many processes in place to make sure it stays relevant to its target customers. It continues to execute at retail better than anyone in the industry.

And there’s always China.